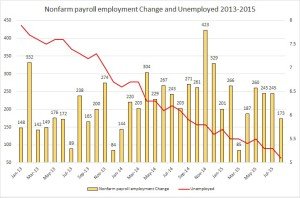

The U.S. non-farm payroll report came up short with only 173K jobs added in August. The ADP report estimated an increase of 190K jobs and the market expectations were at 220K for August – this means the NFP came by 47K jobs below market expectations. The last time the U.S. saw a gain in jobs of below 200K was back in April. Back then, the winter was the one to blame. The main sectors that expanded were in health care and social assistance and in financial activities. Manufacturing and mining lost jobs. The rate of unemployment edged down to 5.1%. The U.S. dollar weakened against the Euro and Japanese yen; gold and silver also modestly slide.

Even though the report wasn’t too impressive, the silver lining of the recent report was the modest positive revisions of the previous months’ figures — with a total upward revision of 44K for July and June combined.

Source: BLS

In August, the rate of U.S. unemployment was 1 percent points below the rate recorded in August 2014.

Moreover, the number of unemployed persons also (8.029 million) declined by 237K in August compared to the previous month; while the civilian labor force increased by 220K. So there was a gain in number of people participating in the labor force and a drop in the number of unemployed – another welcomed change in the right direction. Nonetheless, the participation rate was unchanged at 62.6%.

Finally, wages slightly grew in August compared to July – the hourly earnings reached $25.09 per hour; wages – an annual gain of 2.2%, year on year. This isn’t a big change from previous months, but at least shows a margin improvement (albeit it could also be a matter of noise and next month it will come down again closer to 2%).

Bottom line

The recent NFP report wasn’t what people were expecting or hoping for – more so the FOMC was expecting a stronger report to support its shift in policy and its rate hike – regardless of its timing we know it will eventually happen in the coming months. But the report wasn’t so bad – there were upward revisions to the previous months, more people entering the work force, and wages are slowly climbing back up. But perhaps the ongoing weakness in energy and mining is slowly adversely affecting the labor market and partly offsetting the positive impact of low prices on the economy. Nonetheless, this could still mean the FOMC is more likely to err on the side of caution and keep rates a bit longer at their current low levels. So if you thought a September rate hike is still a possibility – perhaps this recent report will make you reconsider.

For further reading: