The recent news from China regarding the low manufacturing PMI, which reached 47.1 the lowest since 2009, has brought down the U.S. stock market. And even the minutes of the FOMC seem to have lowered a bit the odds of a rate hike in September. Precious metals ended last week on a high note – mainly gold. For silver the concerns over China may have acutely reduced the expected growth in demand for this precious metal. The talks over what’s going on with China are likely to keep moving the financial market. Besides these talks, this week the main reports and events in the U.S. include: PCE, durable goods, consumer confidence, Jackson Hole Symposium, pending and new home sales, FOMC Lockhart Speaks. For the complete review for this week’s events and reports see here.

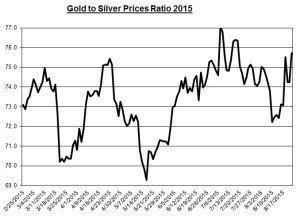

Notice that the price of silver has started to under perform, again, the price of gold in the past few weeks. The current ratio is close to 76. For now, this upward direction may continue as the bullion market remains weak – after all in times of weakness in the precious metals market, gold is likely to do better than silver.

The concerns over China are likely to remain and keep moving the markets. For gold, weaker China could suggest the lower chance of the Fed raising rates – why raise rates when China devalues its currency to support its exports – but it also mean weaker demean for silver ( for manufacturing), which could bring down the price of silver. This may explain the recent different direction gold and silver experienced on Friday after the Caixin flash manufacturing PMI for August dropped to 47.1 – a 77 month low. Bear in mind, the whole issue of China and where it’s heading is likely to keep moving the financial markets in the coming days. Any move from Beijing could also impact the foreign exchange and bullion markets.

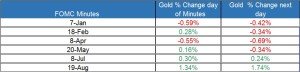

Last week, the minutes of the FOMC were released. In the past, the minutes didn’t have much of an impact on gold prices. But this time around, gold and silver jumped after the minutes were released. The U.S. dollar also weakened against the Euro and Yen.

As of end of the recent week, the implied probabilities of rate hike in September fell to 28%; for December the odds also dropped to 60%.

Looking forward, the PCE, durable good and GDP for Q2 will be the main reports that could move the U.S. dollar and subsequently gold and silver.

By the end of the previous week, the gold holding of the GLD ETF rose again by 0.89% to 677.82 tons of gold – the highest level since the end of July. It’s still down for the year by 4.8%. The silver holdings of the leading silver ETF SLV remained unchanged at 324.9 million ounces.

What’s next?

The market conditions – the confusion about the Fed’s policy, the concerns over China, and the fall in the U.S. stock market – are keeping up gold and silver. These circumstances are likely to further behoove for bullion investors in keeping precious metals up. Also, if the U.S. dollar keeps coming down, as it did in recent weeks, gold and silver are likely to benefit from these turn of events and keep recovering. But keep in mind that this rally may not last long and could change direction again if the U.S. economy show signs of progress, e.g. GDP and consumer sentiment present higher than expected results, and the market changes its estimates about whether the FOMC raises rates in September.

For further reading see: