Even though the recent NFP report presented much better than expected gains in jobs – 287K compared to 175K outlook – the bullion market didn’t react much and if anything silver kept rising on Friday. It seems that the ongoing drop in interest rates continue to fuel the recovery of bullion prices. This week’s focus will shift back to Britain as the BOE will decide on its monetary policy. This news could shake up not only the Britain pound but also other markets including commodities and equities. The main news and reports to look for in the U.S. include: retail sales, JOTLS, consumer sentiment, CPI and industrial production. So let’s breakdown the news and events that could move precious metals for the week of July 11-15.

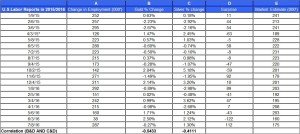

The NFP report showed a strong gain in number of jobs, but the other indicators weren’t too impressive including the growth in wages – a monthly growth of 0.1% when the market expected a growth of 0.2%. But overall gold prices slightly declined on Friday while silver kept rising.

Source: BLS, Bloomberg

And overall both gold and silver rose by 1.4% and 2.6%, respectively during the past week. The market is likely to keep digesting the NFP report, which could impede the progress of gold and silver. Also, if the upcoming report including retail sales consumer sentiment and JOLTS beat the market estimates, this could suggest the U.S. economy isn’t doing so poorly and shift back the market sentiment towards risk-on environment. But for bullion, the main issue will remain what’s next for interest rates and for now they are expected to keep coming down. Even though the NFP report was good, the market still place a very low chance of a Fed rate hike: According to Fed-watch, by the end of last week the implied probability of the cash rate cut in July is still at 1.2%; for September, again, a 1.1% chance of a cut; and for December the odds of a hike have slightly moved up but are still low at 24% with a 0.9% chance of the rates coming down by 25 basis points.

These forecasts suggest the market still expects low inflation and low interest rates in the near term, which could help keep pushing up gold and silver in the coming months.

In Europe the main event will be the BOE rate decision. Currently the market expects a 25 basis point rate cut, which could slightly bring down the GBP. But any additional stimulus – e.g. a further rate cut or introducing more QE – could send further down the GBP against major currencies. If the BOE doesn’t introduce any stimulus, this could also have a strong impact on the markets and send the British pound back up. For gold and silver, in either way, a surprise from the BOE could raise the anxiety in the markets, which may drive their prices up.

ETFs holdings: By the end of last week, gold holdings of the gold ETF SPDR Gold Trust (GLD) increased again – for the sixth straight week — by 3.28%, week on week, to 981.26 tons of gold; silver holdings for the silver ETF iShares Silver Trust (SLV) also increased by 2.4% to 341.45 million ounces.

What’s next?

The strong headline figure of the NFP didn’t slow down the bullion market; and considering interest rates keep falling, gold and silver are likely to maintain their upward trend. And it should be noted that the BOE could still stir up the markets especially if the BOE surprises the markets and introduce an unexpected stimulus or doesn’t act. And finally, if the upcoming economic data from the U.S. show additional better-than-expected results, this could impede the rise of gold and silver prices.

For further reading see: