Precious metals took another dive this week after the hawkish FOMC minutes kept resonating the markets. And the recovery of the U.S. dollar – mostly against the Euro and Yen – also contributed to the weakness of the bullion market. But this could change this week if the next U.S. reports show lower figures than expected. This week’s main reports in the U.S. include: U.S. NFP, factory orders, core PCE, consumer sentiment, and manufacturing and non-manufacturing PMI. And in Europe the ECB rate decision will be the main event of the week. Let’s examine the main events and reports that could move gold and silver for the week of May 30- June 3.

Let’s focus of three events that will lead the way in impacting the bullion market:

1.U.S. NFP: Last time the report, yet again, was a mixed bag but was still overall disappointing: as the headline figure showed a gain of 160K but wage growth edged up to a 2.5% annual rate; this time, the market expects a low gain in jobs of 160K and wages to rise by 0.2%, month over month. Any lower growth rate on both jobs and wages could lead to another bearish shift, a reduction in the odds of a rate hike in the coming meetings, a weaker U.S. dollar and gold and silver prices bouncing back.

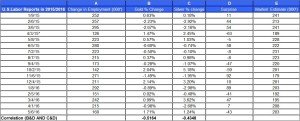

Source: Bloomberg, BLS

The chart above shows the market reaction of the bullion market to the changes in the NFP headline figure and the gap from market estimates

2. U.S. PCE: Even though this report doesn’t tend to move markets as the NFP does, it’s still an important report considering we are getting closer to the June meeting; the Fed follows this report as its prime estimate of U.S. inflation. Considering the core CPI declined in the past couple of months, we are likely to see a modest fall in the annual rate of core PCE. If so, it doesn’t vote well for a rate hike – as long as prices don’t pick up, the Fed has less of an incentive to raise rates – and this could help drive up gold and silver prices;

3. The ECB rate decision: The ECB isn’t expected to introduce any new policy measures, but this event is still likely to move markets especially the Euro. The Euro isn’t likely to do much this month.

As of the end of last week, the implied probability of a rate hike, based on Fed-watch, is 28% in June – little changed from the previous week; for a September hike the odds slightly climbed to 69% and for December the odds rose to 81%. The table below summarizes the market expectations for a rate hike in the coming meetings.

Source: Fed-Watch

ETFs holdings: By the end of last week, gold holdings of the gold ETF SPDR Gold Trust (GLD) edge down by 0.1%, week on week, to 868.66 tons of gold; silver holdings for the silver ETF iShares Silver Trust (SLV) also declined by 0.1% to 335.74 million ounces.

What’s next?

Even though the chances of a rate hike in June picked up over the past week, they could come back down if the core PCE shows even lower inflation and the NFP disappoint again. Also, even though Yellen said a rate hike could be appropriate in the coming months she still didn’t offer a clear cut guidance about raising rates in June, which could be interpreted by the market as a sign that rates won’t go up in June or even July. If so, the bullion market could reheat in the near term.

For further reading see: